Expedite your nonfiction book discovery process with Readara interviews, summaries and recommendations, Broaden your knowledge and gain insights from leading experts and scholars

In-depth, hour-long interviews with notable nonfiction authors, Gain new perspectives and ideas from the writer’s expertise and research, Valuable resource for readers and researchers

Optimize your book discovery process, Four-to eight-page summaries prepared by subject matter experts, Quickly review the book’s central messages and range of content

Books are handpicked covering a wide range of important categories and topics, Selected authors are subject experts, field professionals, or distinguished academics

Our editorial team includes books offering insights, unique views and researched-narratives in categories, Trade shows and book fairs, Book signings and in person author talks,Webinars and online events

Connect with editors and designers,Discover PR & marketing services providers, Source printers and related service providers

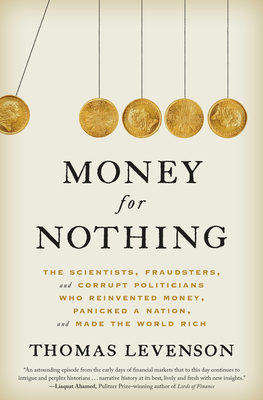

Money for Nothing: The Scientists, Fraudsters, and Corrupt Politicians Who Reinvented Money, Panicked a Nation, and Made the World Rich

Business & Economics > Economic History

- Random House

- Hardcover

- 9780812998467

- 9.7 X 6.4 X 1.5 inches

- 1.6 pounds

- Business & Economics > Economic History

- (Single Author) Asian American

- English

Readara.com

Book Description

LONGLISTED FOR THE FINANCIAL TIMES AND MCKINSEY BUSINESS BOOK OF THE YEAR AWARD - An astounding episode from the early days of financial markets that to this day continues to intrigue and perplex historians . . . narrative history at its best, lively and fresh with new insights.--Liaquat Ahamed, Pulitzer Prize-winning author of Lords of Finance

Money for Nothing chronicles the moment when the needs of war, discoveries of natural philosophy, and ambitions of investors collided. It's about how the Scientific Revolution intertwined with finance to set England--and the world--off in an entirely new direction.

At the dawn of the eighteenth century, England was running out of money due to a prolonged war with France. Parliament tried raising additional funds by selling debt to its citizens, taking in money now with the promise of interest later. It was the first permanent national debt, but still they needed more. They turned to the stock market--a relatively new invention itself--where Isaac Newton's new mathematics of change over time, which he applied to the motions of the planets and the natural world, were fast being applied to the world of money. What kind of future returns could a person expect on an investment today? The Scientific Revolution could help. In the hub of London's stock market--Exchange Alley--the South Sea Company hatched a scheme to turn pieces of the national debt into shares of company stock, and over the spring of 1720 the plan worked brilliantly. Stock prices doubled, doubled again, and then doubled once more, getting everyone in London from tradespeople to the Prince of Wales involved in money mania that consumed the people, press, and pocketbooks of the empire.

Unlike science, though, with its tightly controlled experiments, the financial revolution was subject to trial and error on a grand scale, with dramatic, sometimes devastating, consequences for people's lives. With England at war and in need of funds and stock-jobbers looking for any opportunity to get in on the action, this new world of finance had the potential to save the nation--but only if it didn't bankrupt it first.

Author Bio

Professor Thomas Levenson is the winner of Walter P. Kistler Science Documentary Film Award, Peabody Award (shared), New York Chapter Emmy, and the AAAS/Westinghouse award.

His articles and reviews have appeared in The Atlantic, the Boston Globe, Discover, and The Sciences. He is winner of the 2005 National Academies Communications Award for Origins.

Source: MIT - Comparative Media Studies

Videos

No Videos

Community reviews

No Community reviews